Caixin Explains: Why So Many Chinese Investors Are Green and Leafy

The first in a series of articles exploring distinctive characteristics of China's economy

China’s domestic stock markets have had a bumpy ride in 2018, hit by the trade war with the U.S. and a sliding yuan. But rollercoaster moves on Chinese bourses are hardly a rare sight — and part of the reason is that many investors are about as stock-savvy as a vegetable.

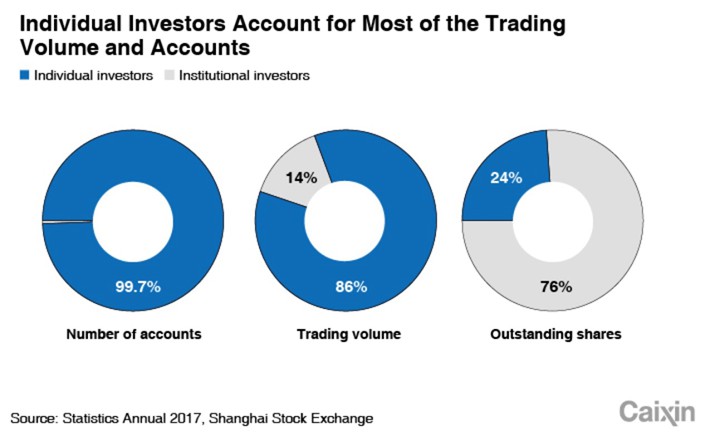

Turnover on the volatile Chinese stock market is driven by hordes of individual retail investors, known as “scattered” investors (散户sǎnhù). Over 99% of investor accounts on the Shanghai Stock Exchange were held by individuals, as opposed to institutions or companies, according to 2017 statistics. Institutional investors, (or 大户 dàhù), are the ones who actually hold the majority of shares, however. (See our chart for details)

These mom-and-pop investors are also known, often self-deprecatingly, as chives (韭菜, jiǔcài). Just as chives will sprout again and again after their stems are chopped and stuffed into dumplings, groups of sanhu will keep throwing cash into the markets to try to get back all the money they lost the last time.

|

- 1Exclusive: China May Add 6 Trillion Yuan in Treasury Bonds to Buttress Economy

- 2Finance Movers and Shakers: Sovereign Fund Unit’s New President, Ex-Central Bank Deputy’s Death Sentence

- 3Briefing: Chinese Stocks Fall Ahead of Expected Fiscal Stimulus Announcement

- 4China Unveils Fiscal Stimulus Targeting Property Market, Local Government Debt

- 5Caixin Explains: The Power Grid’s Solar and Wind Problem

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas