Analysis: Why China’s GDP Growth Slowed in Second Quarter

Listen to the full version

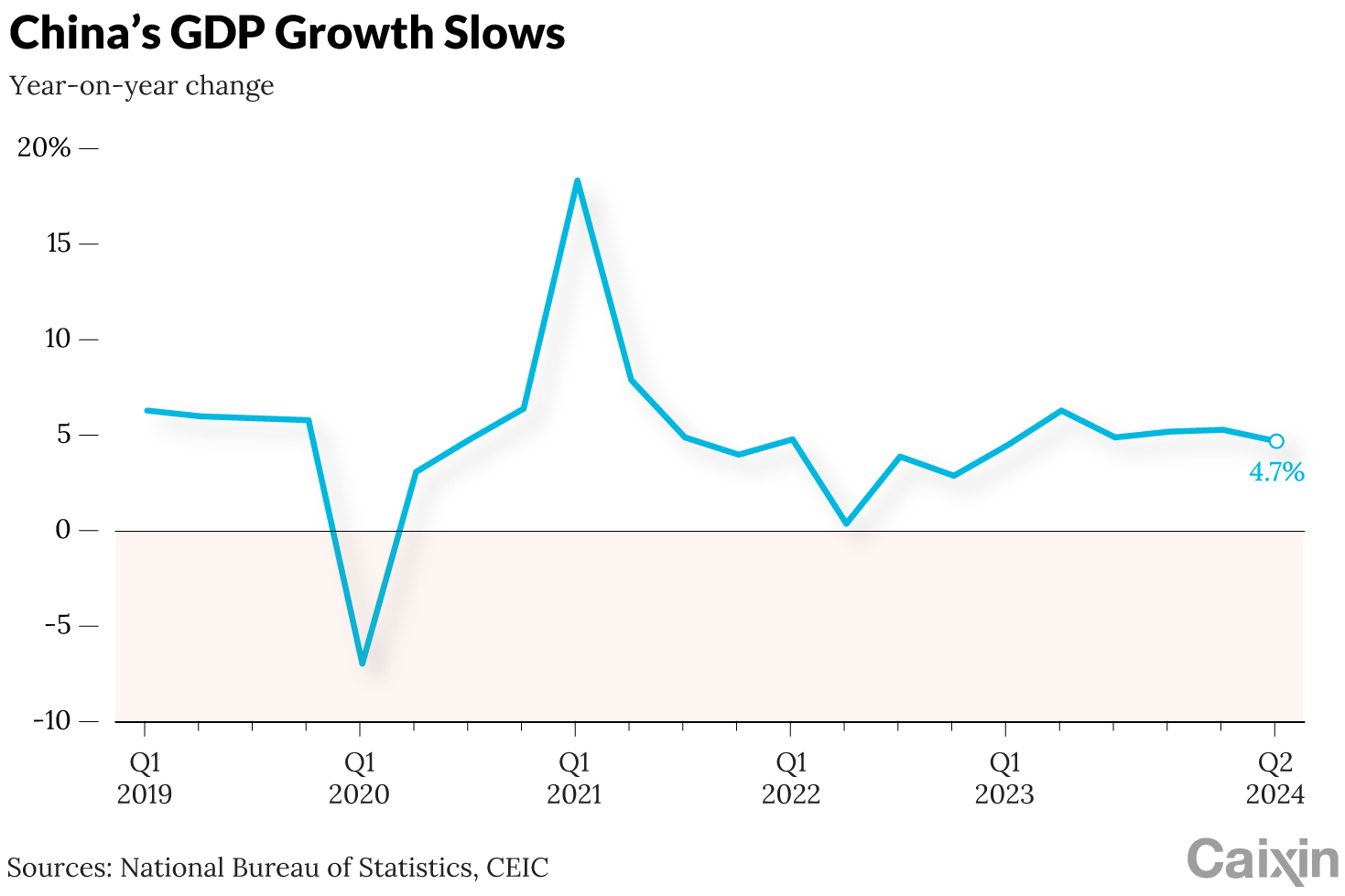

Weak domestic demand and an ailing property market, compounded by extreme weather conditions, contributed to China’s lower-than-expected GDP growth in the second quarter, analysts said.

The 4.7% year-on-year growth in the April-to-June period came after an expectation-beating first-quarter figure that had some economists revising upwards their forecasts for China’s growth rate for the year.

|

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China's GDP growth for Q2 was 4.7%, lower than expected, due to weak domestic demand, a troubled property market, and severe weather.

- Q2 data indicated strong manufacturing output but sluggish domestic demand, with exports playing a significant role in supporting growth.

- Retail sales growth was weak, influenced by a drop in auto sales, online retail fluctuations, and factors like heavy rainfall and negative wealth effects from declining housing prices.

- China International Capital Corp. Ltd.

- China International Capital Corp. Ltd. analysts noted that the slowdown in consumption in June was primarily due to a 6.2% year-on-year drop in automobile retail sales and a 1.4% decline in online retail sales compared to May's 12.9% growth. The decline in online sales may also be due to earlier-than-usual seasonal promotions.

- UBS Group AG

- UBS Group AG economists noted that sluggish consumption growth in China can be attributed to factors such as heavy rainfall and flooding in southern China, "soft income growth and negative wealth effect from housing price decline." They expect real estate sales to improve in the upcoming months due to policy support and foresee solid expansion in exports, manufacturing, and infrastructure investment in the third quarter. They predict modest quarter-on-quarter GDP growth recovery in the second half of the year.

- Guosheng Securities Co. Ltd.

- Guosheng Securities Co. Ltd. analysts reported that although year-on-year growth in value-added industrial production dipped to a three-month low in June, seasonally adjusted month-on-month growth improved from May. This improvement is likely related to strong exports, with significant gains in sectors such as medicine, machinery, and food and beverages.

- Yuekai Securities Co. Ltd.

- Yuekai Securities Co. Ltd. analysts highlighted major uncertainties for China's second-half economic prospects, particularly questioning whether real estate sector support policies will lead to a sustained recovery.

- First half of 2024:

- Investment in property development in China plunged 10.1% year-on-year.

- Second quarter of 2024:

- China's GDP growth was lower than expected at 4.7% year-on-year.

- April-to-June 2024:

- China experienced 4.7% year-on-year GDP growth.

- May 2024:

- China experienced a 12.9% expansion in online retail sales.

- June 2024:

- China's retail sales expanded only 2% year-on-year by value.

- June 2024:

- Automobile retail sales in China dropped 6.2% year-on-year.

- June 2024:

- Year-on-year growth in value-added industrial production dipped to a three-month low.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新