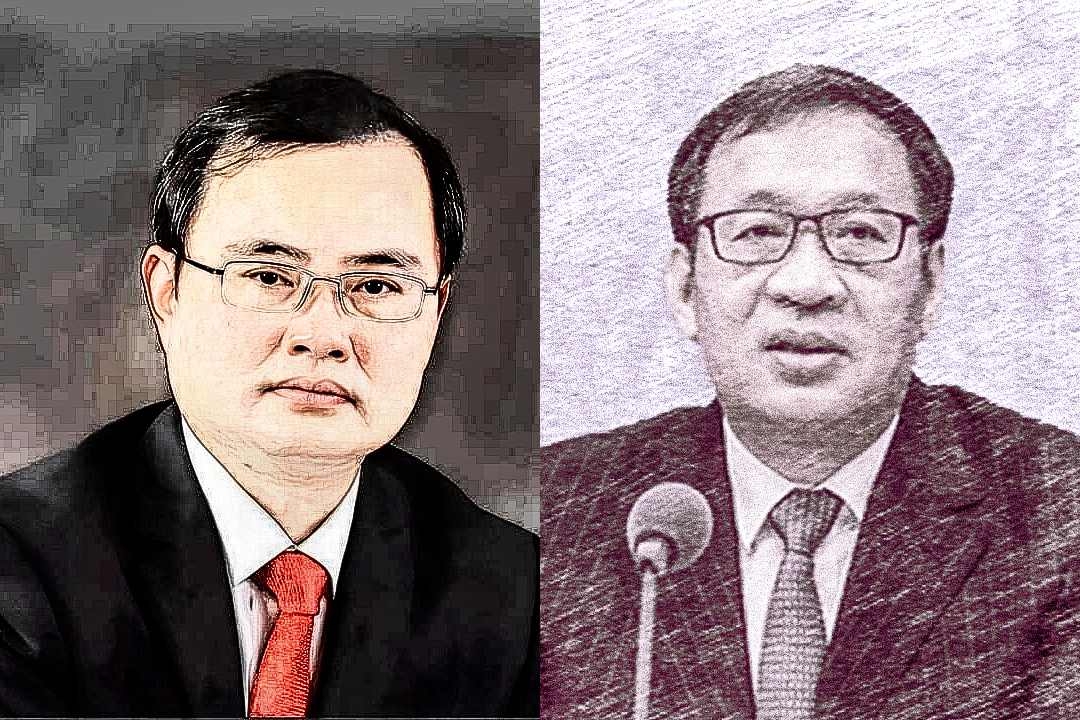

Finance Movers and Shakers: Sovereign Fund Unit’s New President, Ex-Central Bank Deputy’s Death Sentence

Listen to the full version

Welcome to Finance Movers and Shakers, a biweekly newsletter covering significant personnel changes and corruption scandals shaping China’s finance sector.

Subscribe now to receive this newsletter.

# Who’s Moving

Central Huijin’s new president

Central Huijin Investment Ltd. has named Liu Jiawang as its new president, the company announced late last month. It is the domestic arm of China Investment Corp. (CIC), the world’s second-largest sovereign wealth fund by assets.

Liu — a former executive vice president at Agricultural Bank of China Ltd., one of the country’s “Big Four” state-owned banks — succeeded Shen Rujun, who has retired. Liu has also taken over as a vice chairman of Central Huijin. The announcement came one month after Liu was appointed an executive vice president of CIC.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Liu Jiawang has become the new president and vice chairman of Central Huijin Investment Ltd., taking over from Shen Rujun.

- Gong Xingfeng is promoted to president of New China Life Insurance Co. Ltd., amid the crackdown on corruption in Chinese finance.

- Former NCL chairman Li Quan and ex-PBOC deputy governor Fan Yifei face legal consequences for corruption; Lin Qiang, linked to a major economic crime, was arrested after fleeing China.

Finance Movers and Shakers is a biweekly newsletter focusing on major personnel changes and corruption issues in China’s finance sector. The publication provides valuable insights into leadership shifts and regulatory challenges affecting major financial institutions in China. [para. 1]

Central Huijin Investment Ltd., the domestic arm of China Investment Corp. (CIC), announced Liu Jiawang as its new president. Liu, previously an executive vice president at Agricultural Bank of China Ltd., one of China’s “Big Four” state-owned banks, takes over from Shen Rujun, who retired. Liu also took over as a vice chairman of Central Huijin, and this move closely follows his appointment as an executive vice president of CIC. [para. 3]

Gong Xingfeng has been promoted to president of New China Life Insurance Co. Ltd. (NCL), subject to regulatory approval. This move marks a significant shift as Gong replaces Zhang Hong, who is retiring. Gong, who joined NCL in 1999, has held several roles, including chief actuary and vice president since 2016. His appointment is critical as NCL faces increased scrutiny amidst China’s crackdown on financial corruption, with some of its former leaders embroiled in scandals. [para. 5]

In a focus on corruption scandals, Li Quan, former chairman of NCL, has been arrested for bribery and embezzlement. His expulsion from the Communist Party emphasizes the severity of the charges, reflecting ongoing anti-corruption efforts in China’s finance sector. [para. 7]

Fan Yifei, a former deputy governor of the People’s Bank of China (PBOC), received the death penalty with a two-year reprieve for accepting over 386 million yuan ($53.3 million) in bribes between 1993 and 2022. Fan’s case illustrates the breadth of corruption issues, as he facilitated loans, job placements, and contracts in return for bribes across various roles in the central bank and state-owned firms. [para. 9]

Additionally, Lin Qiang, a Chinese businessman and former chairman of the now-insolvent HHSC Capital, was arrested in Bali for his involvement in illegal fundraising and transferred to Interpol. Lin allegedly orchestrated an economic crime in China, raising over 100 billion yuan from more than 50,000 victims. After fleeing China in August 2023, Lin's arrest marks a significant development in the case, highlighting the scale of financial misconduct and its cross-border implications. [para. 11] The investigation by Shanghai police into HHSC Capital further underscores the gravity of the firm’s fraudulent activities, as it halted payments on asset management products likely totaling around 30 billion yuan. [para. 13]

Overall, Finance Movers and Shakers offers an essential overview of the evolving financial landscape in China, characterized by leadership transitions and a stringent crackdown on corruption. The newsletter underscores the importance of governance and transparency in financial institutions and the impact of regulatory measures on corporate leadership. Readers are encouraged to review past editions for a broader understanding of these ongoing trends and to contact the involved reporters and editors for more insights.

- Central Huijin Investment Ltd.

- Central Huijin Investment Ltd. is the domestic arm of China Investment Corp. (CIC), the world's second-largest sovereign wealth fund by assets. The company recently named Liu Jiawang as its new president, succeeding Shen Rujun. Liu, a former executive vice president at Agricultural Bank of China, has also taken over as a vice chairman of Central Huijin, following his appointment as an executive vice president of CIC one month prior.

- China Investment Corp.

- China Investment Corp. (CIC) is the world's second-largest sovereign wealth fund by assets. Central Huijin Investment Ltd., its domestic arm, recently appointed Liu Jiawang as its new president.

- Agricultural Bank of China Ltd.

- Agricultural Bank of China Ltd. is one of China’s “Big Four” state-owned banks. Liu Jiawang, the new president of Central Huijin Investment Ltd., previously served as an executive vice president at this bank before moving to his current position.

- New China Life Insurance Co. Ltd.

- New China Life Insurance Co. Ltd. (NCL) has appointed veteran Gong Xingfeng as its new president, pending regulatory approval. Gong, who succeeds Zhang Hong, joined NCL in 1999 and has held multiple roles, including chief actuary. His appointment comes amid heightened scrutiny due to former leaders' involvement in China's anti-corruption crackdown.

- Shanghai Hehe Capital Investment Management Co. Ltd.

- Shanghai Hehe Capital Investment Management Co. Ltd., also known as HHSC Capital, is a now-insolvent firm involved in illegal fundraising. It raised over 100 billion yuan from more than 50,000 victims. The chairman, Lin Qiang, fled China in August 2023 and was recently arrested in Bali. In April, HHSC announced it would halt payments on investor products, with unpaid asset management products totaling around 30 billion yuan. Shanghai police launched an investigation into the group.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新