Chart of the Day: SAIC Likely to Lose Yearly Car Sales Crown to BYD

Listen to the full version

State-owned SAIC Motor Corp. Ltd. is likely to be knocked off its perch as China’s biggest auto seller for the full year by electric vehicle (EV) giant BYD Co. Ltd., ending a nearly two-decade run of dominance.

From January to September, SAIC sold about 2.65 million vehicles, down 21.56% year-on-year, according to a stock exchange filing. Of those, 748,027 were new-energy vehicles (NEVs), up 15.28% year-on-year. The NEV category includes battery-electric cars, plug-in hybrids and fuel cell vehicles.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- SAIC Motor Corp. Ltd. may lose its top spot as China's largest auto seller to BYD, which sold 2.75 million vehicles, up 32.13% in the first nine months of the year.

- SAIC's vehicle sales dropped by 21.56% to 2.65 million, with significant declines in joint ventures like SAIC-GM, while facing challenges from new-energy vehicle makers.

- Tariffs and focus on escalating EV competition push SAIC to reassess strategies, including leadership changes and considering closing combustion engine factories.

- SAIC Motor Corp. Ltd.

- SAIC Motor Corp. Ltd., a Chinese state-owned automaker, is likely to lose its top spot in auto sales to BYD. From January to September, SAIC sold approximately 2.65 million vehicles, with a significant drop in combustion engine vehicle sales. The company is shifting focus to electric vehicles and has reshuffled leadership and released lower-priced models. SAIC also faces challenges in overseas markets, including increased EU tariffs on battery-electric vehicles.

- BYD Co. Ltd.

- BYD Co. Ltd. is an electric vehicle (EV) giant in China that sold around 2.75 million vehicles from January to September, marking a 32.13% increase. In early 2022, BYD stopped producing fossil-fuel vehicles to focus exclusively on electric cars and plug-in hybrids, aiming to sell only zero-emission vehicles globally by 2040. BYD is on track to surpass SAIC as China's biggest auto seller for the full year.

- General Motors Co.

- General Motors Co. is in a joint venture with SAIC, which experienced a significant year-on-year sales drop of 61.55%. This joint venture, focused on combustion engine vehicles, is struggling as SAIC falls behind in shifting towards electrification. GM's partnership is affected by the broader challenges faced by SAIC, including competition from NEV-makers and tariff increases on exports to markets like the EU and the U.S.

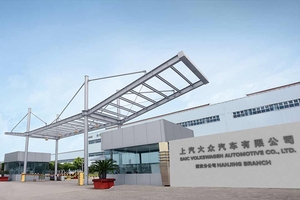

- Volkswagen AG

- Volkswagen AG is a partner in a joint venture with SAIC Motor Corp., which primarily focuses on producing combustion engine vehicles. The JV, SAIC Volkswagen Automotive Co. Ltd., is struggling to keep up with the industry's shift toward electrification, which has led to SAIC considering the closure of a factory that makes combustion engine cars as part of a broader strategy to focus more on electric vehicles (EVs).

- SAIC Volkswagen Automotive Co. Ltd.

- SAIC Volkswagen Automotive Co. Ltd., a joint venture between SAIC and Volkswagen AG, is facing challenges as it falls behind in electrification. The company's focus on combustion engine vehicles, amid an industry-wide shift towards electric vehicles, is contributing to its struggles. SAIC is considering closing a key factory producing combustion cars to focus more on EVs as part of its turnaround strategy.

- SAIC General Motors Corp. Ltd.

- SAIC General Motors Corp. Ltd. is a joint venture between SAIC Motor and General Motors, primarily focused on producing combustion engine vehicles. The company is lagging in the shift towards electrification, contributing to a significant year-on-year sales drop of 61.55%. SAIC is considering closing a factory that makes combustion engine cars in an effort to pivot towards producing more electric vehicles.

- Chery Automobile Co. Ltd.

- Chery Automobile Co. Ltd. is China's largest vehicle exporter, surpassing SAIC. The company's rise in exports comes amid SAIC's difficulties in overseas markets, partly due to increased tariffs, particularly in the EU.

- Tesla Inc.

- Tesla Inc. is affected by the EU's decision to impose extra tariffs on battery-electric vehicles from China, with tariffs ranging from 7.8% for Teslas manufactured in China. These tariffs are part of the EU's response to an anti-subsidy investigation and add to the existing 10% import duties for cars, impacting Tesla's export competitiveness to the EU market.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新