Exclusive: China’s Ganfeng and Minmetals Bid for Stake in Chilean Lithium Salt Flat

Listen to the full version

China’s lithium giant Ganfeng Lithium Group Co. Ltd. (002460.SZ) and state-owned mining major China Minmetals Corp. are among the bidders vying for a stake in one of Chile’s top salt flats, sources familiar with the matter told Caixin.

Chile’s state-run mining company Codelco is seeking a partner to develop a new lithium project in Maricunga salt flat set to start production in 2030. A shortlist of first-round candidates is expected soon, though it may not be disclosed publicly, Caixin has learned.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- Ganfeng Lithium and China Minmetals are competing to partner with Codelco for Chile's Maricunga lithium project, aiming for initial production by 2030.

- Maricunga boasts estimated resources of 8 million tons of lithium carbonate equivalent, with state-required dominant ownership and international interest from over 30 companies.

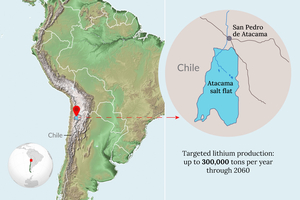

- Chile, the second-largest holder of lithium after Bolivia, produced 44,000 tons in 2023, accounting for 24% of global output, and is enhancing state participation in lithium projects.

- Ganfeng Lithium Group Co. Ltd.

- Ganfeng Lithium Group Co. Ltd. is a Chinese lithium giant involved in bidding for a stake in Chile's Maricunga salt flat project. This project is being developed by Chile's state-run company Codelco and is set to begin production by 2030. Ganfeng Lithium is competing alongside China Minmetals Corp and other bidders, seeking to expand its involvement in the global lithium market amid increasing demand driven by the electric vehicle boom.

- China Minmetals Corp.

- China Minmetals Corp. is a state-owned mining major from China that is among the bidders for a stake in the Maricunga lithium salt flat project in Chile. The company is competing to partner with Chile's state-run mining company, Codelco, for the development of this strategic lithium resource.

- BYD Co. Ltd.

- BYD Co. Ltd. (002594.SZ) is a Chinese firm shortlisted as a potential partner for Chile's Altoandinos lithium salt flat project. This project is part of Chile's efforts to expand state control of its lithium reserves. BYD is among several international companies, including those from South Korea and Australia, expected to enter negotiations with Enami, aiming to form a partnership by March 2025 and begin construction by 2030.

- CNGR Advanced Material Co. Ltd.

- CNGR Advanced Material Co. Ltd. (300919.SZ) is a Chinese company shortlisted as a potential partner for Chile’s Altoandinos lithium salt flat project. They are among the companies being considered by Enami, alongside firms like BYD, LG Energy Solution, Eramet Group, Posco, and Rio Tinto, for this project, with a partnership decision expected by March 2025 and construction starting in 2030.

- LG Energy Solution Ltd.

- LG Energy Solution Ltd. is among the shortlisted potential partners for Chile's Altoandinos lithium salt flat project. The company, alongside others like BYD and Eramet Group, is in negotiations with Enami to potentially form a partnership by March 2025, aiming to start construction by 2030.

- Eramet Group

- Eramet Group, a French company, is included in the shortlist of potential partners for Chile's Altoandinos lithium salt flat project. The company, along with other international firms, is being considered by Enami, the state-owned company managing the project. Negotiations with shortlisted companies are expected to be finalized by March next year, aiming for a partnership by March 2025 and facility construction commencement by 2030.

- Posco

- Posco, a South Korean steelmaker, is among the shortlisted companies for the Altoandinos lithium salt flat project in Chile. The project is managed by state-owned Enami, and Posco is competing alongside firms like BYD, CNGR Advanced Material, LG Energy Solution, Eramet Group, and Rio Tinto. Negotiations for a partnership are expected to conclude by March next year, with construction planned to start by 2030.

- Rio Tinto

- Rio Tinto is one of the potential partners shortlisted for the Altoandinos lithium salt flat project in Chile. This project is being managed by the state-owned company Enami. The process involves forming a partnership by March 2025, with facility construction expected to begin by 2030.

- Tianqi Lithium Corp.

- Tianqi Lithium Corp., a leading Chinese lithium producer, is involved in tensions with SQM, where it is the second-largest shareholder. The planned collaboration between SQM and Codelco could potentially dilute Tianqi's profits from Chile's largest lithium reserve in the Atacama salt flat, amid Chile's move to increase state control over its lithium industry.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新