In Depth: Virtual Power Plants Turn Energy Savings Into Cash for China’s Industrial Users

Listen to the full version

Imagine being paid hundreds of dollars a day just to tweak your energy consumption — using less electricity at night and more during the day. For a casting and smelting company in Shanxi province, this idea became reality.

By joining a virtual power plant (VPP) network, the company raked in a cumulative 1.4 million yuan ($200,000) over the past year, earning about 4,000 yuan a day while cutting its annual electricity bill by 4 million yuan.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- A smelting company in Shanxi earned $200,000 through a virtual power plant (VPP) by optimizing energy use, while lowering its electricity bill by 4 million yuan annually.

- VPPs, utilizing decentralized energy resources, are rapidly growing in China, attracting major investments and government support as they aid in balancing renewable energy supply and demand.

- Despite potential, profitability remains challenging for VPPs due to reliance on subsidies, market control by grid operators, and low user engagement, necessitating reforms and better user incentives for growth.

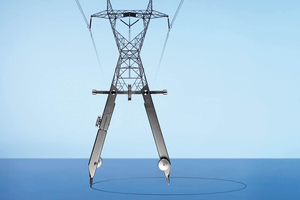

Virtual power plants (VPPs) are revolutionizing China's energy market by using decentralized resources to optimize energy consumption and promote sustainability[para. 1][para. 3]. For example, a casting and smelting company in Shanxi province earned 1.4 million yuan ($200,000) in a year by participating in a VPP network, reducing its electricity bill by 4 million yuan[para. 1][para. 2]. VPPs differ from traditional power plants as they don't generate electricity but instead use internet technology to manage power loads from energy storage, air conditioning, lighting, and EV charging stations to balance supply and demand[para. 4][para. 5]. As more renewable energy sources such as solar and wind are integrated into the energy mix, VPPs help manage their volatility by smoothing out demand peaks[para. 5].

The rise in VPPs has piqued investor interest, with VPP-related stocks surging this year[para. 6]. National policies are also supporting VPP growth, with the National Development and Reform Commission unveiling a plan in August to accelerate the development of a new power system that includes VPPs as a crucial element to achieve carbon neutrality[para. 7]. Industry leaders recognize the increasing attention virtual power plants are receiving, with global companies like Nvidia developing smart meters to allow excess electricity sales from home batteries or EVs[para. 8][para. 9]. With predictions that the VPP market could reach 10.2 billion yuan by 2025 and 100 billion by 2030, cities across China, such as Shenzhen, are launching VPP projects, aggregate resources equivalent to small to midsize power plants[para. 10][para. 11].

Development stages for VPPs typically involve grid operators managing them for stability initially, with profits driven mainly by subsidies. They then progress to interacting with the broader electricity market and eventually engaging in energy trading in a fully open market system[para. 15][para. 20]. The opportunities for growth in China's VPP market are immense, with diverse sectors investing in the field[para. 21]. However, profitability remains challenging since some VPPs heavily rely on government subsidies while struggling to maintain consistent revenue[para. 22]. Established companies with existing infrastructures perform better, although startups face difficulties gaining a foothold[para. 26].

Another challenge is navigating the complex relationship between grid dispatching and market mechanisms, often favoring established power sources such as thermal and hydropower plants[para. 28]. Despite the lower operational costs of VPPs, pricing pressures and competitive rates remain an issue[para. 29]. The introduced national standards for 2025 aim to address these challenges, but more reforms are needed to define VPPs' market roles and ensure fair competition[para. 31][para. 32]. A suggested shift towards a "bottom-up" model could allow microgrids to better manage local supply and demand, opening new opportunities[para. 34].

Engaging users presents another challenge[para. 37]. While China introduced user participation in the energy market in 2015, most users are still passive power recipients[para. 38]. VPP operators must educate users on the benefits of joining VPP networks, but resistance remains due to concerns about production disruptions[para. 40][para. 41]. Yet, as energy prices fluctuate more with renewable energy rise, spot market growth could spur broader VPP adoption, forcing businesses to adjust consumption habits[para. 45][para. 46].

- Shenzhen Auto Electric Power Plant Co. Ltd.

- Shenzhen Auto Electric Power Plant Co. Ltd. is an automatic power supply equipment manufacturer whose shares have surged due to involvement in virtual power plant (VPP) technologies. This trend reflects increased investor interest in VPPs and their potential to reshape the energy market.

- SMS Electric Co. Ltd. Zhengzhou

- SMS Electric Co. Ltd. Zhengzhou is a smart meter manufacturer involved in virtual power plant (VPP) technologies. The company's shares have surged due to its participation in the VPP sector, which is gaining attention from investors and reshaping China's energy market by promoting decentralized energy resources and sustainable practices.

- Beijing Creative Distribution Automation Co. Ltd.

- Beijing Creative Distribution Automation Co. Ltd. is an electricity distribution equipment manufacturer involved in virtual power plant (VPP) technologies. This involvement has contributed to a surge in its stock prices, reflecting increased investor interest in VPPs, which are seen as a future component of the energy industry.

- Huatai Securities Co. Ltd.

- Huatai Securities Co. Ltd. is mentioned in the article as estimating the market for Virtual Power Plants (VPPs) will reach 10.2 billion yuan by 2025 and 100 billion yuan by 2030. This prediction reflects the expected rapid growth and expansion of VPPs in the energy market, driven by technological advancements and increasing integration of renewable energy.

- Shanxi Fangxing Measurement and Control Co. Ltd.

- Shanxi Fangxing Measurement and Control Co. Ltd. is a pioneer in China's VPP sector, managing a capacity of 240,000 kilowatts and connecting users consuming 1.5 billion kWh annually. Despite these figures, end users earn only 0.01 yuan per kWh, highlighting profitability challenges. Although Shanxi's power spot market launched in late 2023, only a few VPPs, including Shanxi Fangxing's, participate, struggling with revenue consistency and reliance on government subsidies.

- Nvidia Corp.

- Nvidia Corp. is developing smart meters for virtual power plants (VPPs) to create an "energy store" model, leveraging artificial intelligence (AI). This model allows customers to sell excess electricity stored in home batteries or electric vehicles (EVs) to neighbors. Nvidia's CEO, Jensen Huang, has identified smart grids as a potentially lucrative application of AI, with the company actively investing in VPP technologies.

- BASF China

- BASF China joined Shanghai's virtual power plant network in July 2023 to enhance energy optimization by participating in peak regulation during high-demand periods. The company aims to maximize renewable energy usage and reduce electricity costs without compromising safety. BASF's European operations have previously utilized VPPs to reduce costs and optimize production schedules, indicating the potential for these strategies in China as the electricity market evolves.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新