Analysis: Improved Capital Returns Key to Sustainable Yuan Strengthening

Listen to the full version

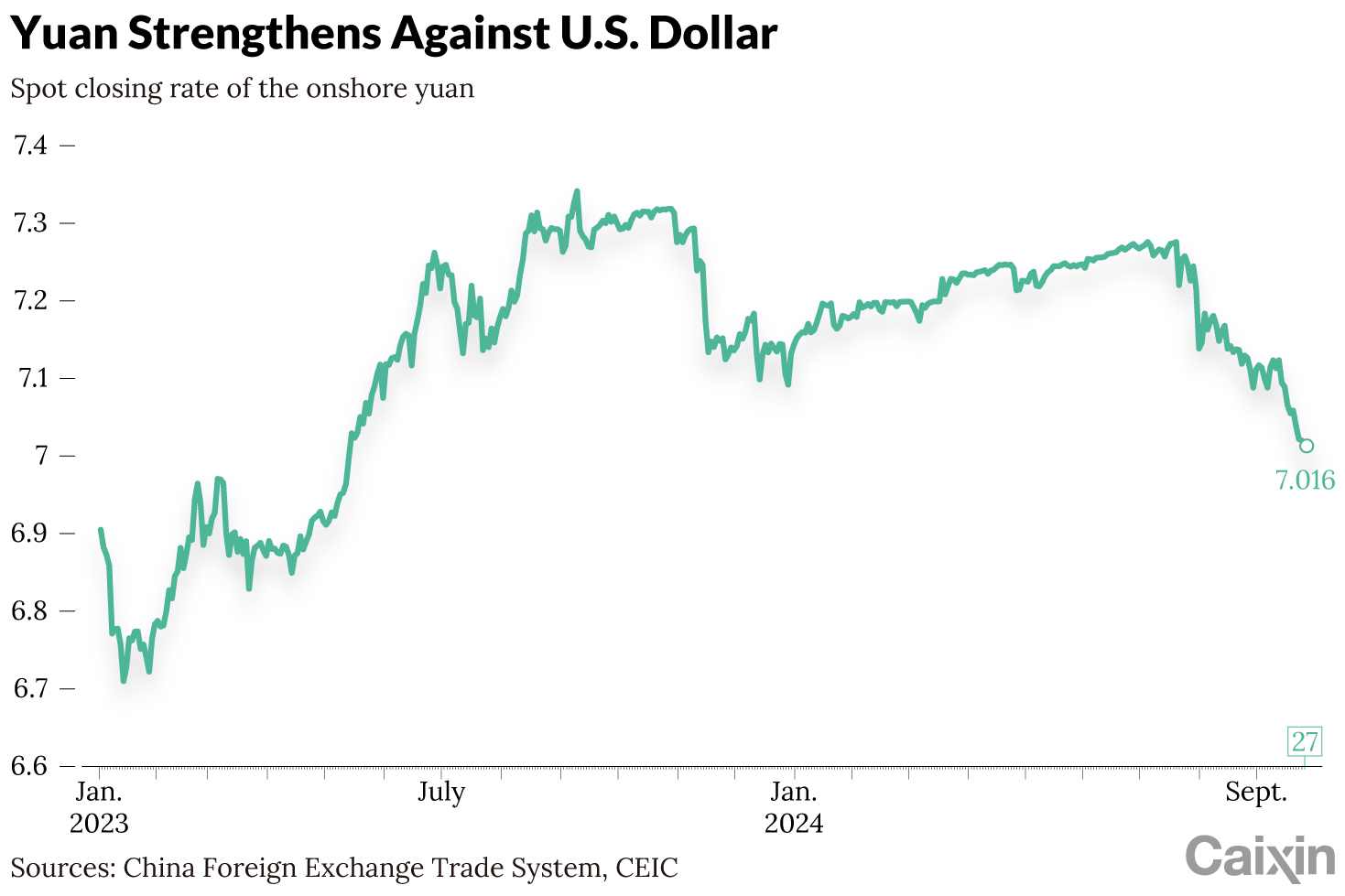

While market concerns about an economic slowdown and deflationary pressure lingered following the interest rate cut by the People’s Bank of China in July, the yuan hit a turning point.

|

Yuan Strengthens Against U.S. Dollar |

By September, the currency had regained all the value it had lost against the U.S. dollar earlier in the year, nearing 7 per dollar. Why has the yuan strengthened so significantly?

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- The yuan regained value against the U.S. dollar, nearing 7 per dollar by September due to expectations of and the actual U.S. interest rate cut of 50 basis points on Sept. 18.

- This currency strengthening is fueled by shifts in corporate behavior, converting U.S. dollars into yuan.

- For sustainable appreciation, China needs to bolster capital returns and improve corporate profitability through proactive fiscal and monetary policies.

- DH Fund Management Co. Ltd.

- DH Fund Management Co. Ltd. is based in Zhejiang province and focuses on macro strategy. Xu Xiaoqing is its director of macro strategy. The company appears to analyze economic trends and monetary policy impacts, particularly in the context of China's financial market and currency movements.

- July 2024:

- Interest rate cut by the People’s Bank of China.

- By September 2024:

- The yuan had regained all the value it had lost against the U.S. dollar earlier in the year, nearing 7 per dollar.

- Sept. 18, 2024:

- U.S. interest rate cut by 50 basis points.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新