Update: China’s Fresh Stimulus Targets Property and Stock Market Challenges

Listen to the full version

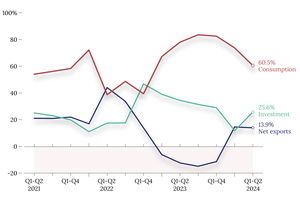

China announced a slew of stimulus measures Tuesday, including lowering rates on existing home mortgages and cutting a key policy rate, as it steps up support for an economy hamstrung by a prolonged property sector slump and lackluster consumer confidence.

Stock markets surged in response to the news, with the benchmark Shanghai Composite Index closing up 4.15%, marking its largest jump in over four years. The Shenzhen Component Index and Hong Kong’s Hang Seng Index also gained more than 4%.

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- DIGEST HUB

- China introduced measures including rate cuts on existing mortgages and a reduced key lending rate to support its economy.

- The People's Bank of China (PBOC) will decrease mortgage rates by 0.5 percentage points and lower the minimum down payment for second homes to 15%.

- Additional measures include a 0.5-percentage-point reduction in the reserve requirement ratio, 300 billion yuan for affordable housing, and new tools to bolster stock market liquidity.

- People's Bank of China

- The People's Bank of China (PBOC) announced several stimulus measures to support the economy, including lowering rates on existing home mortgages, reducing the minimum down payment for second homes, funding a 300 billion yuan loan initiative for affordable housing, and cutting the reserve requirement ratio. Additionally, short-term policy rates and national loan prime rates will be lowered to stabilize banks' net interest margins. The PBOC is also creating tools to bolster stock market holdings by financial institutions and listed companies.

- 2024:

- The PBOC will fully fund a 300 billion yuan loan initiative for state-owned enterprises (SOEs) to buy unsold homes and turn them into affordable housing units.

- Within the year 2024:

- Banks’ reserve requirement ratio (RRR) may be further lowered by between 0.25 and 0.5 percentage points.

- Tuesday, September 24, 2024:

- China announced a slew of stimulus measures, including lowering rates on existing home mortgages and cutting a key policy lending rate.

- September 24, 2024:

- The People's Bank of China (PBOC) announced it will guide commercial banks to lower the rates paid on existing home mortgages.

- PODCAST

- MOST POPULAR

Sign in with Google

Sign in with Google

Sign in with Facebook

Sign in with Facebook

Sign in with 财新

Sign in with 财新